-

General assessment:

- Android versions:

2.1 and higher - Category:

Programs » Finance - Developer:

Тачков Дмитрий - Languages:

Russian - The size:

2.7 MB - Views:

5821 - Show all

Credit Calculator PRO 3.5.2

Credit Calculator is a professional credit calculator designed to calculate consumer loans and mortgages. A feature of the calculator is the calculation of a loan with early repayments

The application allows you to calculate the following types of loans:

1. Mortgage in the primary and secondary housing market

In the primary market, it is possible to change the rate during the loan through early repayment, if the rate is the same before obtaining ownership rights, and then changes.

2. Consumer credit

3. Loan with repayment in the form of maternity capital

4. Car loan

5. Military mortgage

6. Mortgage on land and on a private house, as well as a loan for a garage

7. Mortgage on the room

8. Vacation and study loans.

9. Credit for a wedding or other event

The main features of the credit calculator

1. Loan calculation (payment type - differentiated and annuity)

2. The ability to send an online loan application by choosing the most favorable offer of the bank

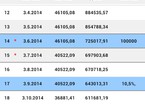

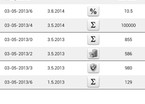

3. Calculation of the loan payment schedule, taking into account early contributions. Displays the days off marked with an asterisk on the graph.

4. Accounting for commissions and insurance when calculating the total overpayment on the loan.

5. Accounting for early repayments when building a loan payment table.

6. Calculation of the schedule when the first payment is only due to the payment of interest on the loan

7. Saving your calculations to the phone's memory and the ability to download

8. Export calculations to an html file when sending by email.

The correctness of the calculations of the loan calculator has been verified on mortgage and consumer loans of the largest banks in Russia. The application was developed initially for its own needs. But due to the demand for the application among ordinary people, it was decided to release a version for Android phones.

The process of working with the application is quite simple:

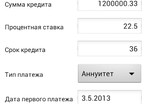

1. Enter the loan data - rate, term, dates, period in months

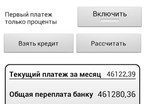

2. Click calculate - the loan is calculated and saved in the database

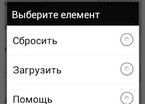

3. To reset the credit - you need to select reset in the menu

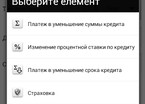

4. To add early payments, go to the early payments tab and select add in the menu. It is possible to add early payments with a reduction in the loan term, payments to repay the debt, as well as commissions, insurance and changes in the interest rate on the loan.

5. To download a saved loan, select download from the menu on the first tab and click on the blue button next to the desired loan. The loan will be loaded and paid off.

6. The language of the application is changed in the settings - you need to click the settings button.

Here you can also set the loading mode of the last loan - the last calculated loan will always be loaded at the start.

7. Export of a loan with a payment schedule is made through the menu on the "Schedule" tab

The export takes place in the html format of both credit and early payments. The latest version of the financial manager Credit Calculator PRO download for android.

Download Credit Calculator PRO on android

- Program version: 3.5.2

- Downloaded: 2979

- Comments from the site

- Minecraft 1.14.0.9

- Vkontakte 5.46

- Lucky Patcher 8.5.7

- VK mp3 mod 93/655

- Terraria 1.3.0.7.4

- VK Coffee 7.91

- GTA San Andreas 2.00

- Kate Mobile 53.3

- Pokemon GO 0.157.1

- Freedom 1.8.4

- Google Play Store 17.9.17

- VK App 4.0

- Sims 5.47.1

- Shadow Fight 2 2.0.4

- Last Day on Earth: Survival 1.14.4

- My Telling Angela 4.4.2.451

- Subway Surfers 1.113

- Dream League Soccer 6.13

- Geometry Dash 2.10

- Hungry Shark Evolution 7.0